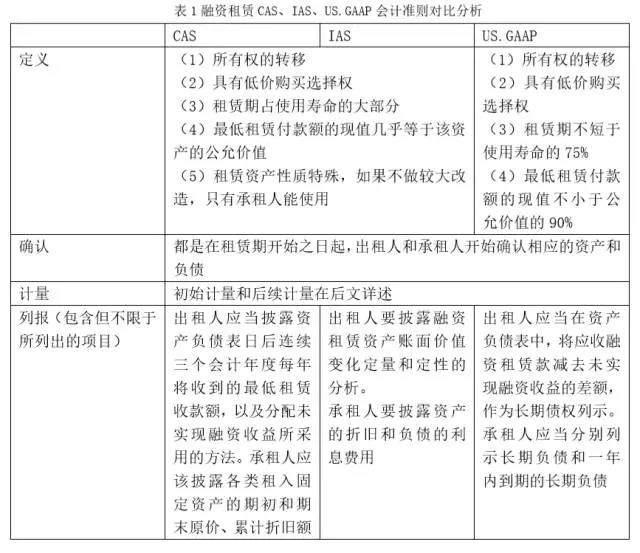

一、初始计量

CAS

出租人:在租赁期开始日,出租人应当将租赁开始日最低租赁收款额和初始直接费用之和作为应收融资租赁款的入账价值,同时记录未担保余值;将最低租赁收款额、初始直接费用、未担保余值之和与其现值之和的差额认为未实现融资收益。

借:应收融资租赁款

未担保余值

贷:资产

未实现融资收益

承租人:在租赁期开始日,承租人应当将租赁开始日租赁资产公允价值与最低租赁付款额现值两者中的较低者作为租入资产的入账价值,将最低租赁付款额作为长期应付款的入账价值,其差额作为未确认融资费用。

借:固定资产

未确认融资费用

贷:长期应付款

初始直接费用,应当计入租入资产价值。

借:固定资产

贷:现金(银行存款)

IAS

For lessee, at the commencement date, a lessor shall recognize assets held under a finance lease in its statement of financial position and present them as a receivable at an amount equal to the net investment in the lease.

For lessee, at the commencement date, a lessee shall recognize a right-of-use asset and a lease liability.

分析:出租人在租赁日开始时,应该确认应收账款并且贷记租出资产。初始直接费用包含在租赁净投资的初始价值之中。

而对于承租人,它的初始计量以成本来衡量资产使用权的价值,并且以未来应付还未付的租金的现值为负债的入账价值。

US.GAAP

For lessor, there are three possible classification:

(1) sales-type

(2) direct financing

(3) leveraged

For sale-type financial lessor, lease receivable of the lessor is equal to the sum of the minimum lease payments plus unguaranteed residual value. The difference between the lease receivable and the present value of itself is recorded as the unearned interest revenue.

对于此类出租人,资产的公允价值和成本不同,所以他们能赚取应收款利息收入以外的利润。

For direct financing lessor, the gross investment is defined as the minimum amount of lease payments exclusive of any executory costs plus the unguaranteed residual value. The difference between the gross investment as determined above and the cost(carrying amount) of the asset is to be recorded as the unearned interest income. Net investment in the lease is defined as the gross investment less the unearned interest income plus the unamortized initial direct costs.

对于直接融资的出租人,资产的公允价值等于成本,所以只赚取应收账款的利息收入。

借:融资租赁应收款

贷:资产

未确认融资费用

For leveraged lease, it must involve at least three parties: an owner-lessor, a lessee, a long-term creditor.

由于此类交易会计处理十分复杂,在此不做详述。后续计量也不涉及此类。

For lessee, capital lease is recorded as an asset and an obligation at an amount equal to the present value of the minimum lease payment at the beginning of the lease term. The asset is recorded at the lower of the present value of the minimum lease payments or the fair value of the asset.

分析:如果公允价值比现值小,我们需要将公允价值作为租入资产的初始价值,这时,贴现率需要重新计算。

二、后续计量

CAS

出租人:未实现融资收益应当在租赁期内各个期间进行分配(实际利率法),或有租金在实际发生时计入当期损益。

承租人:未实现融资费用应当在租赁期内各个期间进行分摊(实际利率法)。租入资产应当采用与固有资产相一致的折旧政策计提租赁资产折旧。或有租金在实际发生时计入当期损益。

IAS

A lessor shall recognize finance income over the lease term, based on a pattern reflecting a constant periodic rate of return on the lessor’s net investment in the lease.

After the commencement date, a lessee shall measure the right-of-use asset applying cost model, revaluation model or fair value model. A lessee shall measure the lease liability by increasing the carrying amount to reflect interest, reducing the carrying amount to reflect lease payments, and reflect any modification.

分析:融资租赁出租人的后续计量和中国会计准则是一致的。融资租赁承租人的后续计量和普通的长期贷款的计量是一样的,用实际利率应计的利息增加负债,已付利息减少负债。

US.GAAP

For sales-type lessor, the resulting unearned interest revenue is to be amortized into income using the effective interest method.

For direct finance lessor, the unearned lease (interest) income and the initial direct costs are amortized to income over the lease term to yield a constant effective rate of interest on the net investment.

For lessee, the annual rent payments made during the lease term are allocated between a reduction in the obligation and interest expense in a manner such that the interest expense represents the application of a constant periodic rate of interest to the remaining balance of the lease obligation. This is commonly referred to as the effective interest method.

分析:这里可以看出,出租人和承租人的后续计量是对应的。承租人所付租金,一部分覆盖了利息费用,余额部分减少负债。而出租人所收租金,一部分为利息收入,余额部分减少资产。并且承租人是需要计提租赁资产的折旧的。

参考文献

【1】《中国会计准则第21号-租赁》电子版

【2】INTERNATIONA FINANCIAL REPROTING STANDARD No.16 LEASE

【3】WILEY GAAP 2017-interpretatio-Joanne M. Flood 电子版

END

关于我们

“叁墨管理咨询”是业界和学界联合打造的、传递和分享会计审计税务的思想、理念、方法技术、心得经验的平台。朋友们在工作中或是休息时从这个平台可以获得一些有价值、有启发作用的资料和资讯。

,